The U.S. and more than 20 other countries pledged to triple uranium fueled nuclear power by 2050 to achieve net-zero carbon emissions and limit climate change.

Middle East (Home of Big Oil) aggressively securing nuclear energy supply

Most Japanese reactors coming back online due to Japan’s change in energy policy

More reactors operating now than in any other time in history

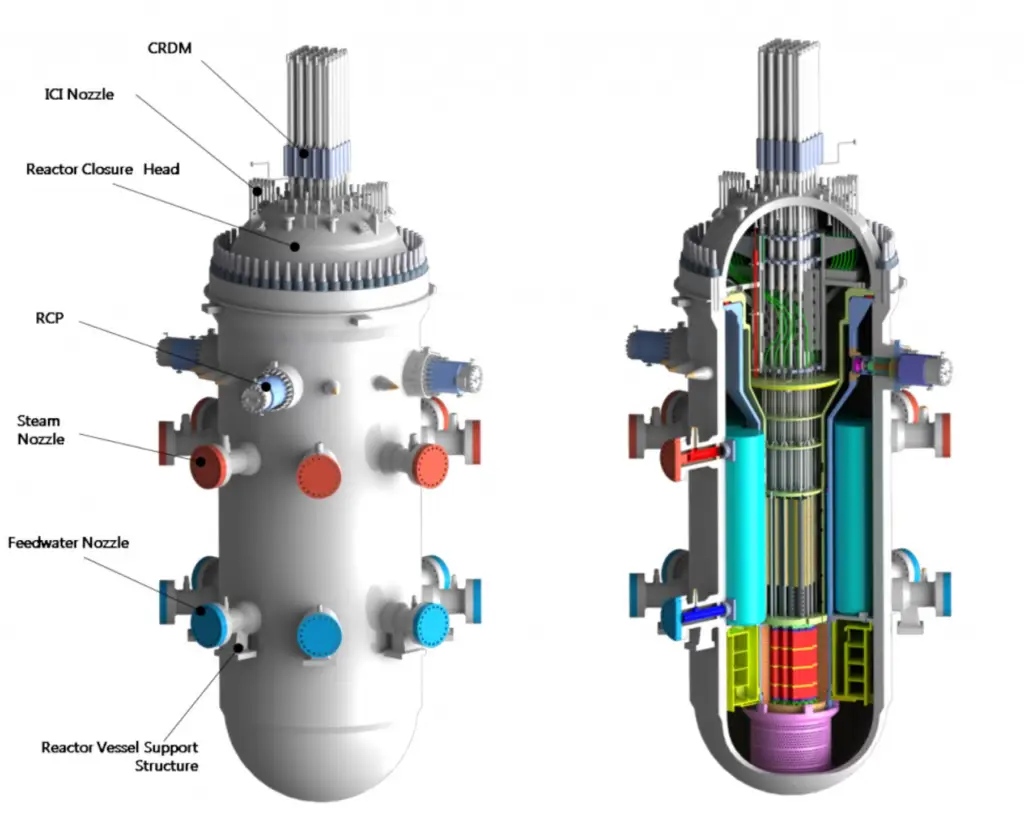

SMRs will offer advantages such as small physical footprints, reduced capital investment, ability to be sited in locations not possible for larger nuclear plants, and provisions for incremental power additions.

Rolls-Royce has been backed by a consortium of private investors and the UK government ($276 million) to develop small nuclear reactors to generate cleaner, affordable energy

Bill Gates and Warren Buffet are currently building a $4B small nuclear power plant in Wyoming

Morgan Stanley’s Commodity Research has identified uranium as the top investment for the coming year, underlined by the uranium industry’s anticipated record term of contracting in 2022, with a reported annual deficit of 60 million lbs. over the next decade, highlighting the need for higher prices to boost production.

The demand for uranium is surging to unprecedented levels, driven by the global push for decarbonization and the adoption of nuclear power as a ‘green’ energy source, indicating a ‘Nuclear Renaissance’ in response to climate change and net-zero targets.

The U.S. Department of Energy has announced a nuclear development plan more ambitious than China’s, aiming to add 13GW of nuclear power annually, reflecting the strategic importance of nuclear energy in future power generation plans.

Source: https://liftoff.energy.gov/wp-content/uploads/2023/03/20230320-Liftoff-Advanced-Nuclear-vPUB-0329-Update.pdf

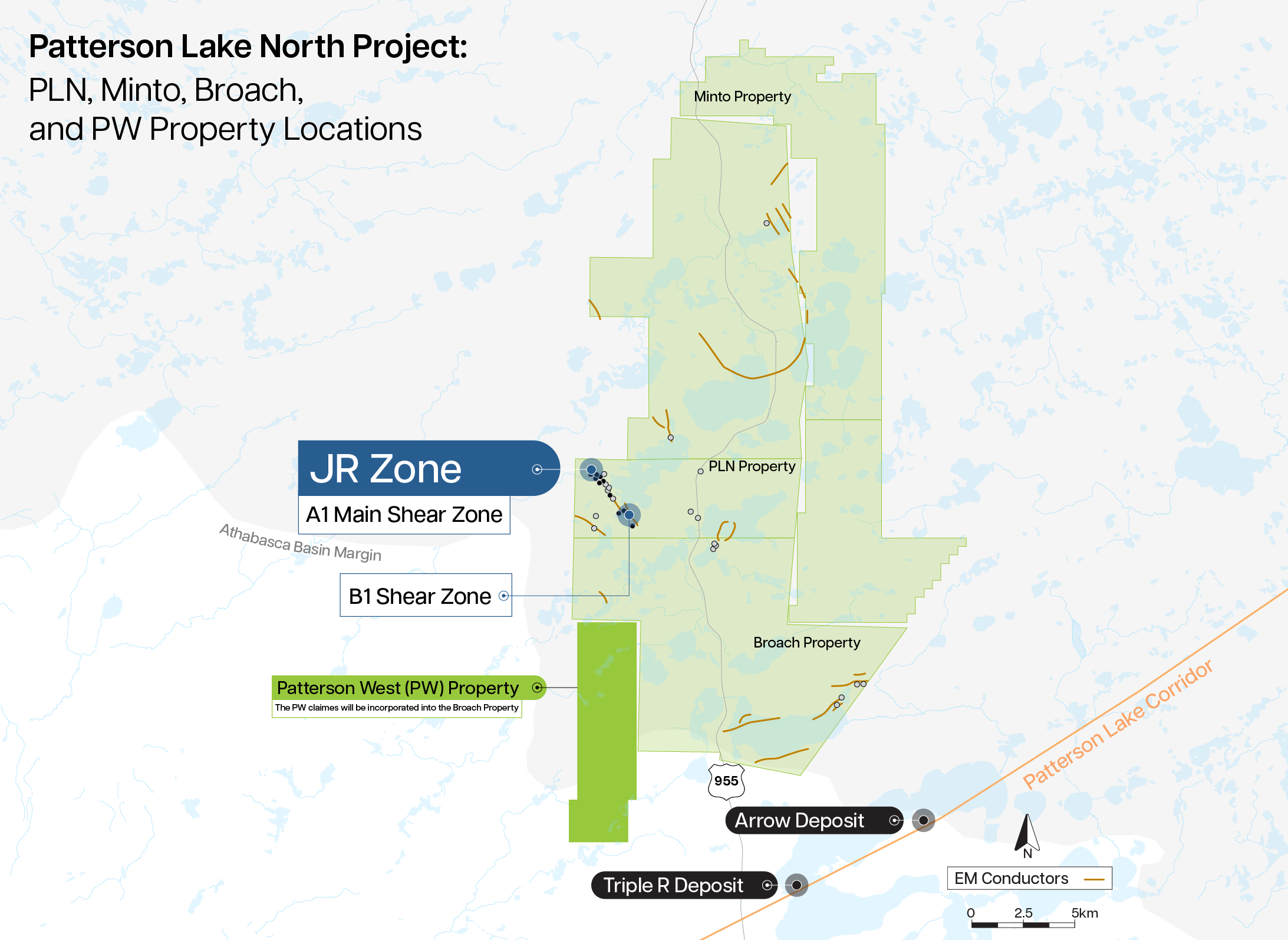

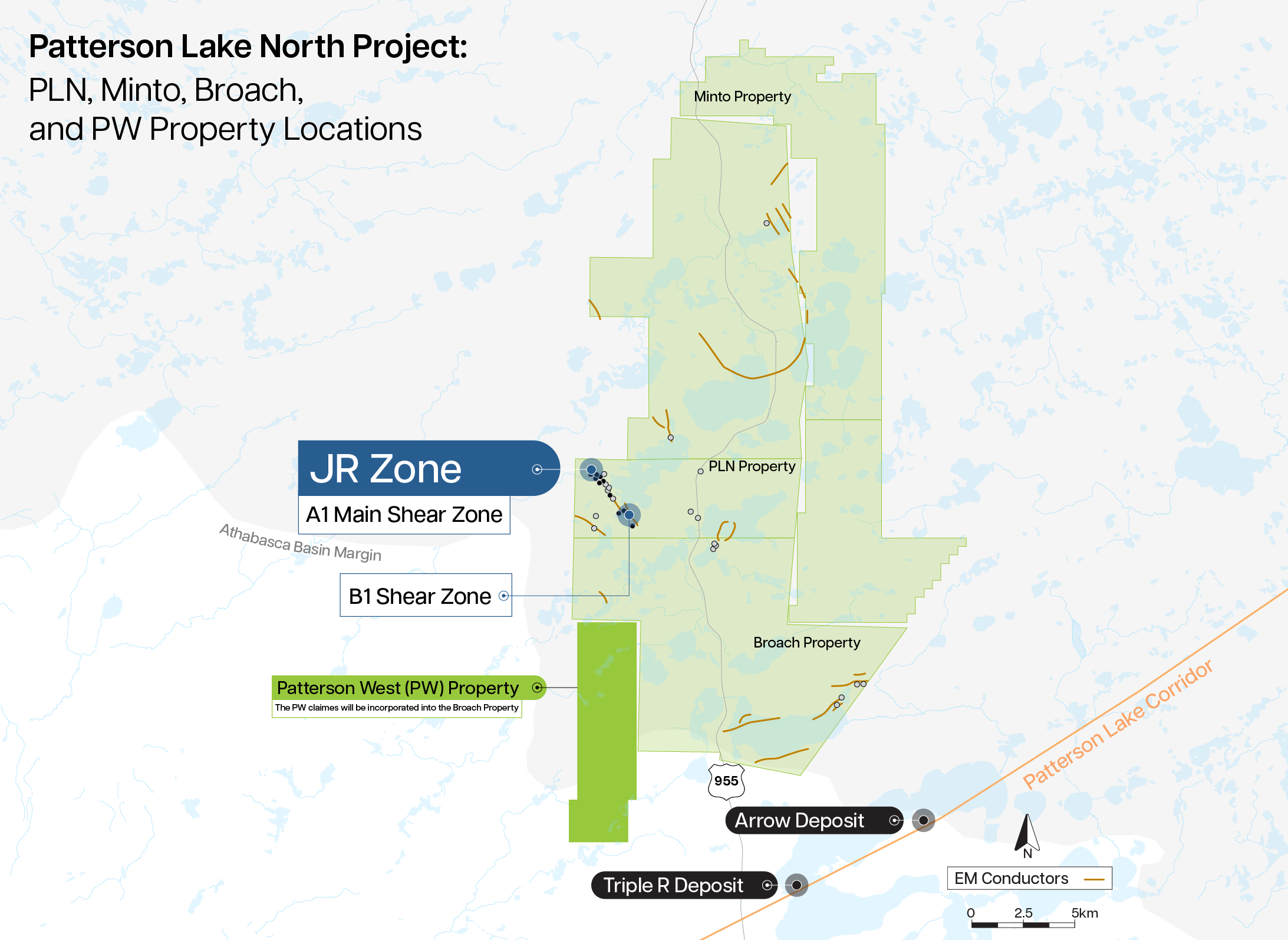

The grades are 10 to 20 times the global

average in the Athabasca Basin.

Newest high grade uranium discovery in the Athabasca Basin

New JR zone discovery – PLN Property

Drilling Highlights of Discovery Hole PLN22-035:

• 15.0m @6.97% U₃O₈ (257.7m to 272.5m), including

• 5.5m @18.6% U₃O₈ (260m to 265m), further including

• 1.0m @59.2% U₃O₈ (263.0m to 264.0m)

Newest high grade uranium discovery in the Athabasca Basin

New JR zone discovery – PLN Property

Drilling Highlights of Discovery Hole PLN22-035:

• 15.0m @6.97% U₃O₈ (257.7m to 272.5m), including

• 5.5m @18.6% U₃O₈ (260m to 265m), further including

• 1.0m @59.2% U₃O₈ (263.0m to 264.0m)

Denison Mines announces a $15 million investment with F3 in the form of a convertible debenture. The Debentures will carry a 9% coupon (the “Interest”), payable quarterly over a 5-year term and will be convertible at Denison’s option into common shares of F3 at a conversion price of $0.56 per share representing a 30% premium to F3’s five-day volume weighted average share price on the TSX Venture Exchange as of October 5, 2023.

David Cates, President and CEO of Denison commented, “F3’s technical team has an incredible track record of exploration success including the discovery of the JR Zone on the Patterson Lake North (“PLN”) property, which represents one of the top new uranium discoveries globally. We are pleased to be investing in F3, supporting the further assessment of the PLN property, and providing Denison shareholders with exposure to this exciting new discovery in the Athabasca Basin.“

Dev Randhawa, CEO of F3 commented, “We are pleased to welcome Denison as a strategic investor in F3. Denison is a uranium industry leader, possessing a diverse array of both early and advanced stage assets in the Athabasca Basin, where F3 is currently advancing the PLN property. We highly value Denison’s perspectives on uranium exploration and look forward to pursuing a productive relationship.”

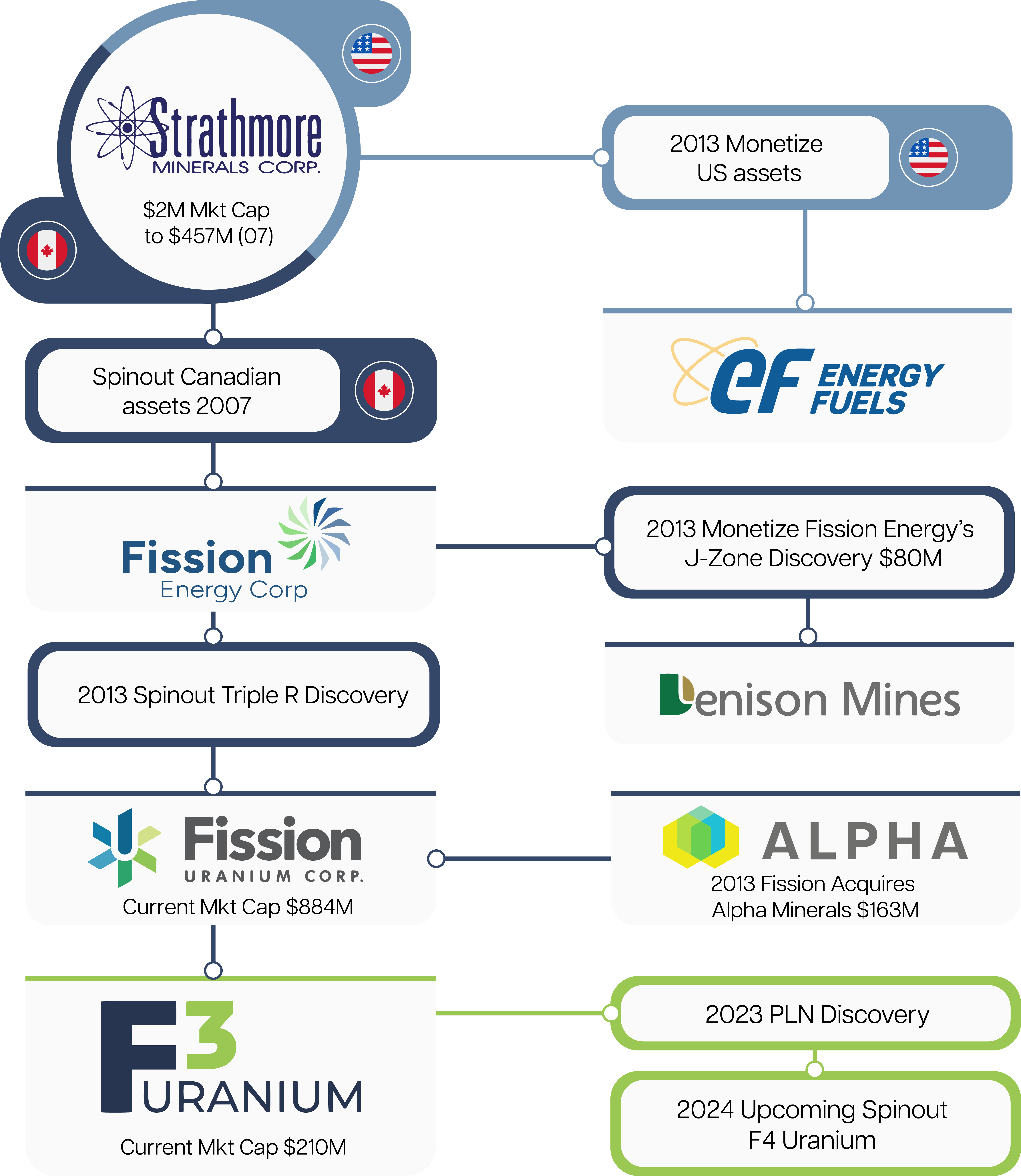

Former CEO & Founder of Fission Energy and Fission Uranium.

Former CEO & Founder of Strathmore Minerals.

Prior to founding his first listed company, Dev Randhawa established himself as a successful investment banker.

Raymond has worked in the mineral exploration industry for 40 years. He was a key member of the technical team that discovered Ekati, Canada’s first commercial diamond mine, Fission Energy’s J Zone uranium deposit at Waterbury Lake and Fission Uranium’s Triple R Deposit at the PLS Project.

Ray headed up the technical team that has made the new JR uranium discovery at F3’s PLN Project.

Sam is an established geologist with extensive experience with Athabasca uranium deposits. His experience ranges from exploration and discovery, resource drilling and definition to geotechnical work.

Sam’s previous company experience was with Fission Uranium where he was on the technical team that made the Triple R discovery in 2012 and over last decade took the project from discovery to feasibility, lastly as Chief Geologist.

Keep at the forefront of renewable energy developments and breakthroughs.

Subscribe to receiving updates on the newest from F3 Uranium.

Transaction Highlights – One F4 Share for every 10 common shares of F3 held. After the completion of the arrangement, the Company intends to list the shares of F4 on the TSX Venture Exchange

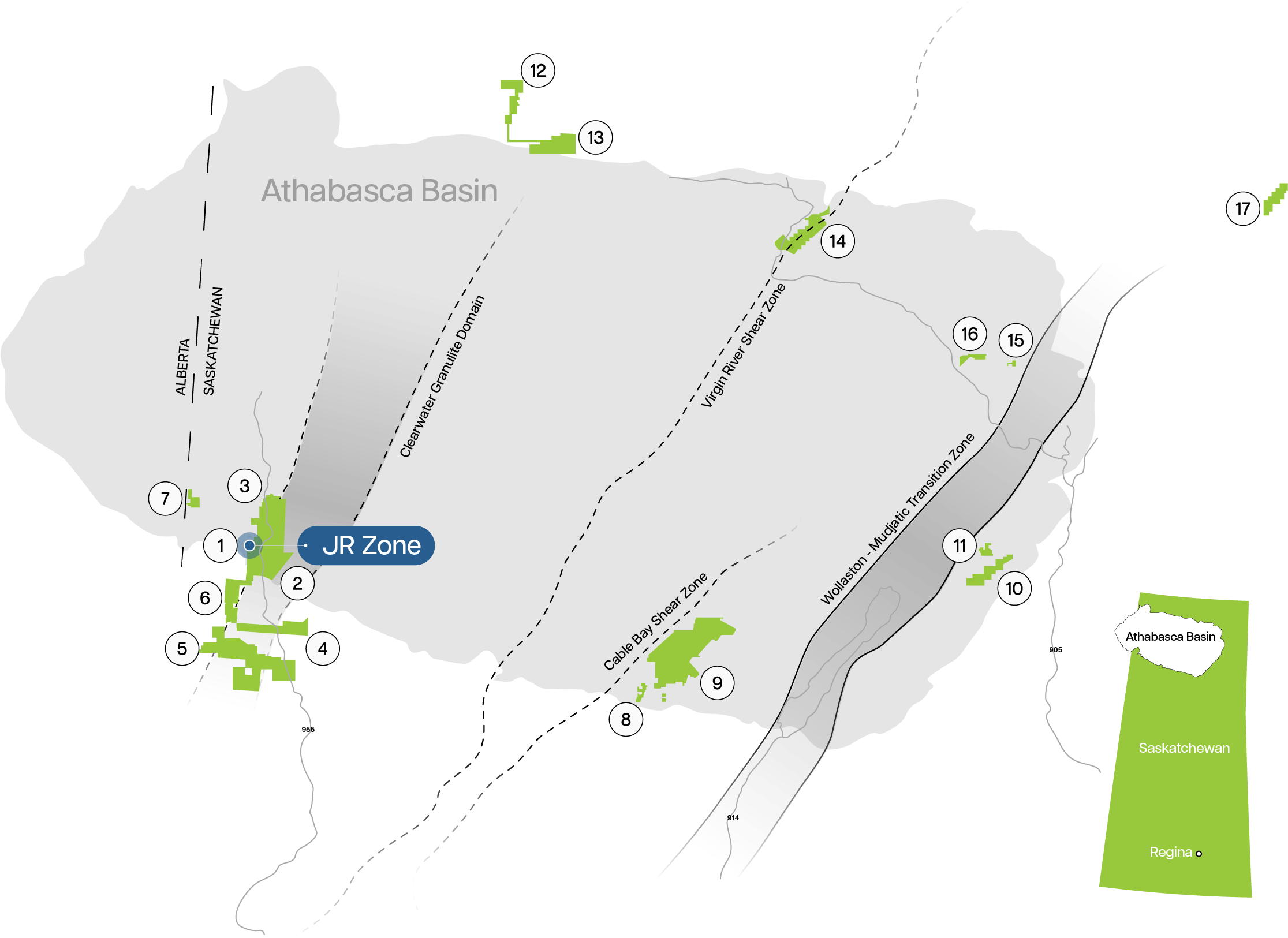

Unlock Value for F3 Shareholders – F4 will surface value in F3’s extensive portfolio of Athabasca Basin uranium exploration assets which are currently overshadowed by the JR Zone discovery at the PLN Project and have correspondingly received minimal capital allocation.

Exceptional Athabasca Basin Portfolio – F4 will hold one of the largest, most prospective uranium exploration portfolios in the Eastern and Western Athabasca Basin totaling 14 projects and 165,907 hectares, many of which are near large uranium deposits.

Preserving PLN Focus – Financing the F4 Properties independently post-Spin-Out will ensure that F3 shareholders do not suffer dilution for non-PLN Project exploration activities.

Experienced Management – F4 will be led by the same award-winning management team responsible for 3 major uranium discoveries in the Athabasca Basin, with Raymond Ashley to be appointed as CEO.

Dev Randhawa, CEO of F3 and incoming Executive Chairman of F4, commented: “Given that the PLN Project has now evolved from important discovery to an entire geological system across multiple shear zones, the board of F3 has determined that the project deserves a singular focus. At the same time, we believe our shareholders will be done a disservice by not pursuing additional discoveries within the rest of our extensive Athabasca Basin portfolio. F4 solves for this dilemma. Substantial synergies will exist between F3 and F4, including technical expertise and corporate costs that would otherwise be borne singularly by each company.”